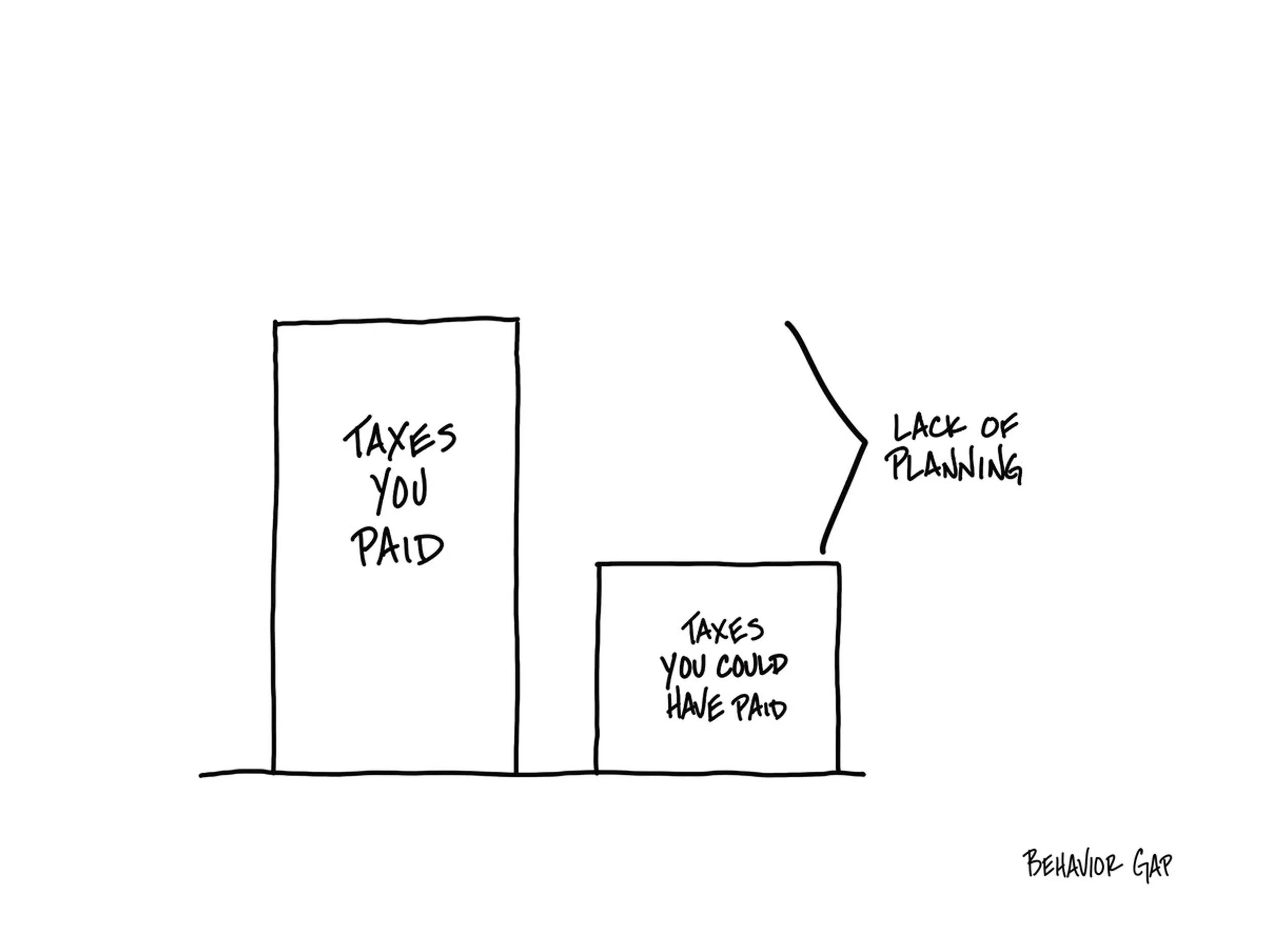

Taxes don’t go away in retirement— they just change shape.

People were told to pile money into 401(k)s, expecting lower taxes later—only to find the opposite.

You may be asking yourself:

It feels like I’m paying more in taxes now than when I worked. Why

Should I be doing Roth conversions?

How can I lower my taxes?

Smart tax-efficient planning can cut your tax bill today and reduce what you’ll owe tomorrow.

Taxes don’t disappear in retirement—they just change shape. We analyze your situation to uncover opportunities to save now and later. That might include Roth conversions, shifting the timing of income, or planning around Medicare and IRMAA surcharges. The rules will keep changing—but smart planning today helps you keep more tomorrow.

Why Choose Coastline Complete Wealth for Your Retirement Planning

-

Certified Financial Planner™

Your CFP® professional upholds the highest standard of excellence in financial planning—ensuring your plan is ethical, evidence-based, and designed around your life.

-

Comprehensive

True comprehensive planning means every detail is integrated—retirement income, tax efficiency, investments, and estate coordination—all working together for your future.

-

Fiduciary Duty

Transparent, fee-only advice with no commissions or hidden costs. We’re legally bound to act in your best interest—always.

-

Local Expertise

For retirees in Bluffton, Hilton Head, Savannah and beyond, we blend smart financial guidance with proactive tax planning—so you can focus on living fully, not managing complexity.