Your retirement deserves a plan, not guesswork.

As independent fiduciary advisors and a CFP® professional, we believe planning should really be called income planning. We turn what you saved into dependable income that keeps up with inflation.

You may be asking yourself:

Do I really have enough—or could I run out?

I’ve never had a real plan. Do I need one now?

I’ve saved my whole life and it seems like enough… but now what?

A successful retirement starts with more than just investments.

Most people don’t have an income problem—they have a planning problem. Retirement isn’t just about investments. It’s about turning savings into a reliable paycheck that lasts and keeps up with inflation. We review everything—Social Security, pensions, rentals—and show you what your retirement income will look like over your lifetime. If there’s a gap between income and desired spending, we build a plan to close it so you can enjoy life, not stress over money.

Operational Review

Portfolio Review

Progress update

Face-to-Face Strategy Update

WHY DO PEOPLE CHANGE ADVISORS?

People change advisors, because they never hear from them. The initial plan is important, but life happens and the plan needs to be updated. We are very committed to regular proactive communication and continuing to update your plan as inevitable life changes occur.

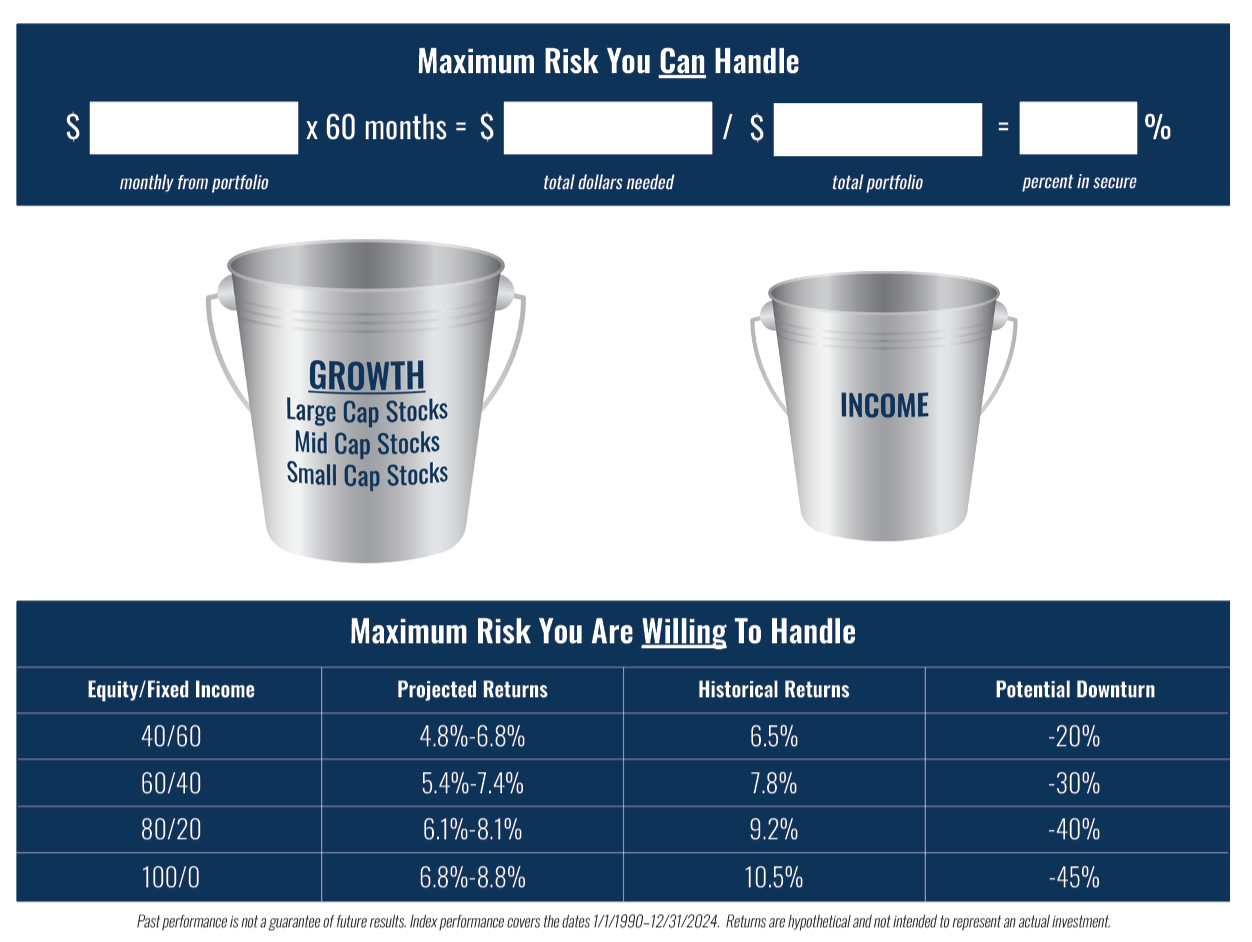

The Risk Optimization Blueprint

Most advisors rely on risk tolerance questionnaires, but the issue with these is that your responses can fluctuate based on current market conditions. At Coastline Complete Wealth, we take a more practical, common-sense approach to assessing risk, ensuring a consistent strategy regardless of market volatility.

Risk and reward go hand in hand. By holding more equities in your portfolio, you’re positioned for greater growth potential and higher long-term returns. Since 1940, U.S. equities have always fully recovered within five years after crashes.* By keeping five years’ worth of expenses in safer investments like bonds or cash, you can avoid selling stocks during downturns, giving your investments time to recover and reducing the risk of locking in losses.

Why Choose Coastline Complete Wealth for Your Retirement Planning

-

Certified Financial Planner™

Your CFP® professional upholds the highest standard of excellence in financial planning—ensuring your plan is ethical, evidence-based, and designed around your life.

-

Comprehensive

True comprehensive planning means every detail is integrated—retirement income, tax efficiency, investments, and estate coordination—all working together for your future.

-

Fiduciary Duty

Transparent, fee-only advice with no commissions or hidden costs. We’re legally bound to act in your best interest—always.

-

Local Expertise

For retirees in Bluffton, Hilton Head, Savannah and beyond, we blend smart financial guidance with proactive tax planning—so you can focus on living fully, not managing complexity.