Not every investment is a good investment.

Our wealth management approach keeps costs transparent—low cost, tax-efficient, and built for both growth and income.

You may be asking yourself:

My account is going up, but so is the market… are these really good investments?

The market makes me nervous—should I back down the risk?

What am I really paying for my investments?

A Not all investments are good—even if they eventually go up.

Truthfully, almost all investments go up if you hold them long enough—but that doesn’t make them good. Our job is to make sure your portfolio works for you. We keep costs low, design for tax efficiency, and diversify across time horizons. We take a simplified approach and use two buckets—some for long-term growth to outpace inflation, others for steady income today. We structure your portfolio to balance both.

Why Choose Coastline Complete Wealth for Your Retirement Planning

-

Certified Financial Planner™

Your CFP® professional upholds the highest standard of excellence in financial planning—ensuring your plan is ethical, evidence-based, and designed around your life.

-

Comprehensive

True comprehensive planning means every detail is integrated—retirement income, tax efficiency, investments, and estate coordination—all working together for your future.

-

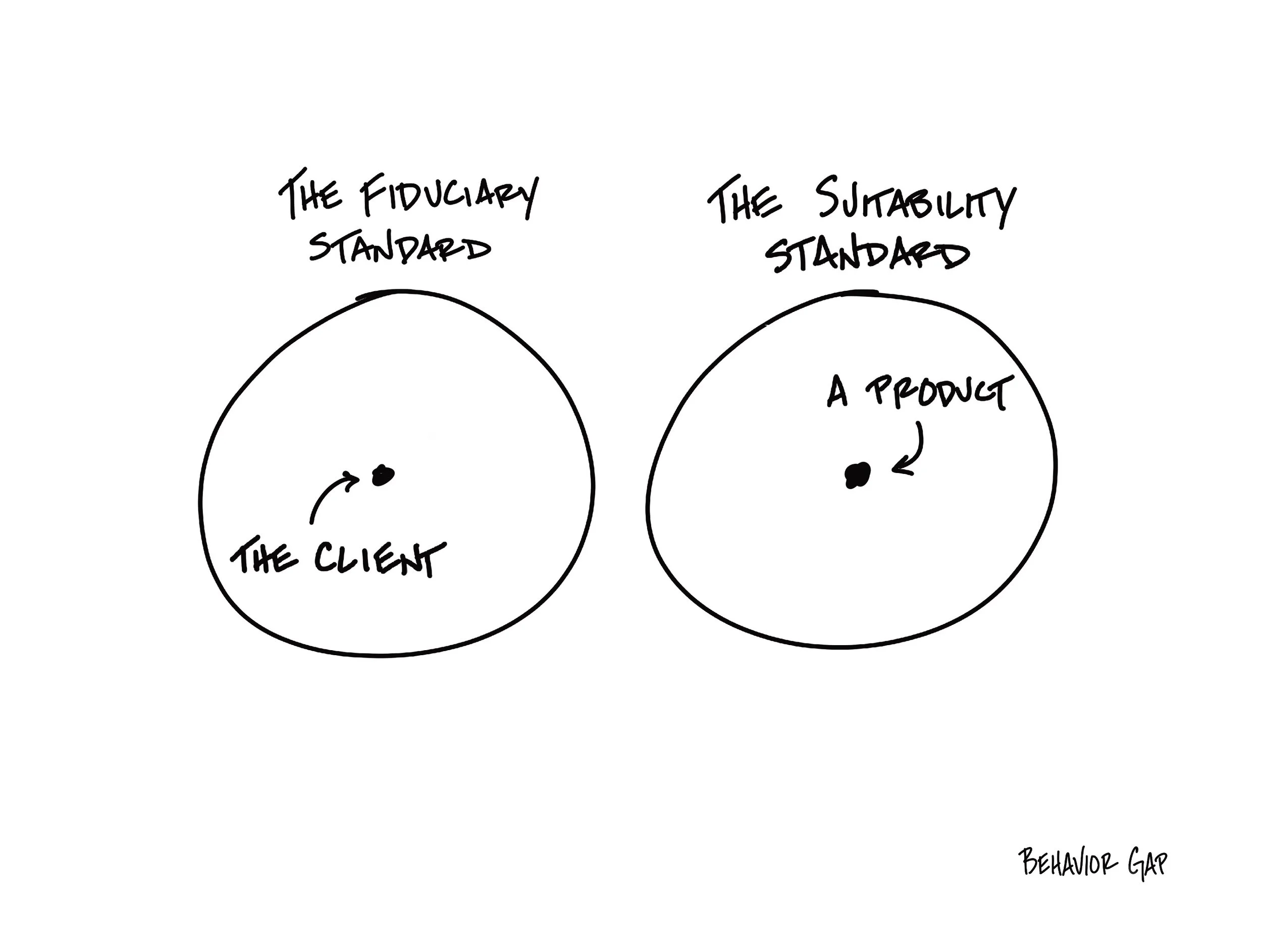

Fiduciary Duty

Transparent, fee-only advice with no commissions or hidden costs. We’re legally bound to act in your best interest—always.

-

Local Expertise

For retirees in Bluffton, Hilton Head, Savannah and beyond, we blend smart financial guidance with proactive tax planning—so you can focus on living fully, not managing complexity.